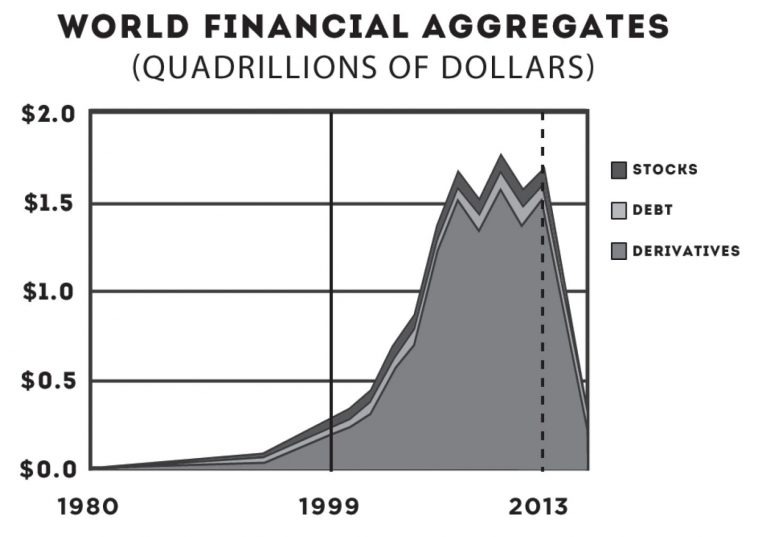

LaRouche’s “Typical Collapse Function” pedagogical graph provides the best tool for understanding the process now underway. Since the assassination of John F. Kennedy and the launching of the Vietnam war, the rate of growth of the U.S. physical economy has been negative. Against that, a hyperbolically rising growth of total financial aggregates (such as derivatives) was buttressed by growing monetary assets. During this phase of the growth of the speculative financial bubble, at a certain point the rate of growth of monetary aggregates had to exceed the growth rate of the financial assets, just to keep that asset bubble from bursting—a policy sometimes known as “bail out” or “quantitative easing.”

With the shift to the British Empire’s attempted “bail-in” policy, a process of uncontrolled implosion of financial aggregates has been unleashed — like the free-fall of an elevator from the 70th floor of a building. And Wall Street and the City of London are so bankrupt and so desperate, that they have begun to market what they themselves call “bail-in bonds” — bonds that will be rendered worthless at the point of a bail-in. That’s like buying and selling seats on an elevator in free-fall — with the notion of somehow being able to jump off safely at the tenth floor.

What are the magnitudes involved in the imploding speculative bubble? In 1999, at the point that Glass-Steagall was repealed in favor of the Gramm-Leach-Bliley-Lewinsky bill, estimated total financial aggregates worldwide stood at only $275 trillion. Today, that bubble has grown hyperbolically to about $1.7 quadrillion—a sextupling in 14 years! As a result of the British Empire’s bail-in policy, you can expect about $1.5 quadrillion in worthless financial assets to go up in smoke.

That is the driving force for thermonuclear war, and that is why Franklin Roosevelt’s Glass-Steagall law must be reinstated.

Related Articles